By Don | September 30, 2011

Being in the business, we get this question from time to time – and it’s impossible to answer in a sound bite! The short answer is that there are too many variables for a quick number like 4%.

Being in the business, we get this question from time to time – and it’s impossible to answer in a sound bite! The short answer is that there are too many variables for a quick number like 4%.

What kind of loan? Conventional, FHA? What’s the loan to value (LTV)? What’s your credit score? Do you want an interest rate lock? For how long? How much is the loan? Over the $417k conforming limit? What’s your back end ratio (debt to income ratio)?

Let’s take a look at a recent matrix to see how, with conventional financing, variations in FICO scores and loan to value (LTV) amounts affect interest rates…

Read the rest of this article »

Filed under article topic:

Mortgages/Interest rates

Comments Off on Interest rates are super low – so what’s today’s “interest rate”?

By Don | September 30, 2011

Starting tomorrow, the loan limit will drop from $729k to $598,000 ($625k in other markets) as Fannie and Freddie attempt to reduce their financial risks in the shaky housing market. Taxpayers have kept the 2 giant organizations afloat with billions of $$, and policy makers are trying to wean the wobbly real estate industry away from further subsidies.

But with billions having already gone to bankroll the banking and other industries (GM), a lot of us in the real estate industry think now’s not the time to reduce the loan limits in the expensive east and west coast markets.

Comments Off on $598,000 new loan limit for Ventura area

By Don | September 26, 2011

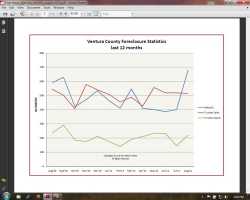

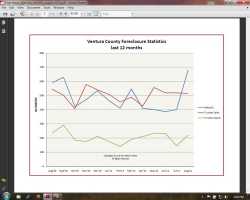

The trend line for  Ventura County Notice of Defaults (first stage of a foreclosure) had seen a gentle decrease over the past 12 months until August, when the numbers dramatically shot up.

Ventura County Notice of Defaults (first stage of a foreclosure) had seen a gentle decrease over the past 12 months until August, when the numbers dramatically shot up.

Specifically, July saw 401 Notice of Defaults but August recorded 678, an almost 70% increase. It takes a minimum of 3 months before a Notice of Trustee Sale can be recorded, and another 21 days before the auction can be set, so we won’t see a spike in REO properties until at least the end of the year.

Also, we’ve seen a lot of properties where the lender sets an auction date, but delays the sale month to month for many months. Shadow inventory issues??

Whatever the reason, it would appear lenders are rapidly stepping up their foreclosures in the County.

Filed under article topic:

Foreclosures

Comments Off on Spike in foreclosures for Ventura County

By Don | September 23, 2011

I’ve just come back from 2 1/2 weeks doing home inspections for FEMA in New Jersey and New York for homeowners hit with hurricane Irene and hit again with torrential downpours from tropical storm Ike.

I’ve just come back from 2 1/2 weeks doing home inspections for FEMA in New Jersey and New York for homeowners hit with hurricane Irene and hit again with torrential downpours from tropical storm Ike.

But I was pulled from that area and sent to Binghamton, New York, where they had just been hit with a 100 year flood. The Susquehanna river had flooded major parts of the city forcing the relocation of hundreds from a senior complex, sending many of them to a rapidly organized shelter at the Events Center (large basketball arena) at the University of Binghamton (SUNY). Many were housed in the “Med unit” which was a quasi medical unit staffed by medical personnel.

It’s tough to lose a lifetime of memories in a major disaster. Another inspector shared how she inspected a heavily damaged home where the lady of the home had just given birth 8 days before her home was flooded. But FEMA has learned from Katrina – it flooded the area with inspectors and had fast turnaround times for those in need.

For me, it was a big change of pace from the “routine” of real estate! We worked literally from sun-up to sun-down, 7 days a week. I skipped lunch every day, did a lot of walking, and lost weight to boot!

Filed under article topic:

Random Stuff

Comments Off on FEMA inspections in New York & New Jersey

By Leslie | September 14, 2011

A new feature of trendlines has been added this month to the three 12 month graphs to give a quick visualization of the numbers sold and the sold prices in Ventura, Oxnard and Camarillo.

Also featured is the percentage of single family homes that were distressed sales in the month of August are:

Ventura – 51% Oxnard – 57% Camarillo – 22%

Sold prices – Single family homes in Ventura, Oxnard, Camarillo:

- 12 month graph – The trendline for Ventura is just above $400k, Oxnard is steady at $300k but bumped up to $315k in August, and Camarillo has been slowly trending downward toward $450k but bumped up to $515k in August.

Sold prices – Condos in Ventura, Oxnard, Camarillo:

- 12 month graph – The trendlines for both Ventura and Camarillo are slowly trending downward, with Oxnard relatively unchanged.

Numbers sold – Single family homes in Ventura, Oxnard, Camarillo:

- 12 month graph – The trendlines for both Ventura and Camarillo are slightly increasing, with Oxnard staying fairly steady.

Detailed data for single family homes sold in:

Detailed data for single family homes sold in:

Detailed data for condos sold in:

Detailed monthly data for pendings (in escrow) – single family homes and condos:

All data is taken from the Ventura, Oxnard and Camarillo MLS.

Comments Off on Trendlines and real estate activity for August in Ventura, Oxnard, Camarillo

Being in the business, we get this question from time to time – and it’s impossible to answer in a sound bite! The short answer is that there are too many variables for a quick number like 4%.

Being in the business, we get this question from time to time – and it’s impossible to answer in a sound bite! The short answer is that there are too many variables for a quick number like 4%. Ventura County Notice of Defaults

Ventura County Notice of Defaults

Detailed data for single family homes sold in:

Detailed data for single family homes sold in: